Description

Key Features:

- No-Code Strategy Builder: Easily create trading strategies using a visual interface, eliminating the need for programming skills.

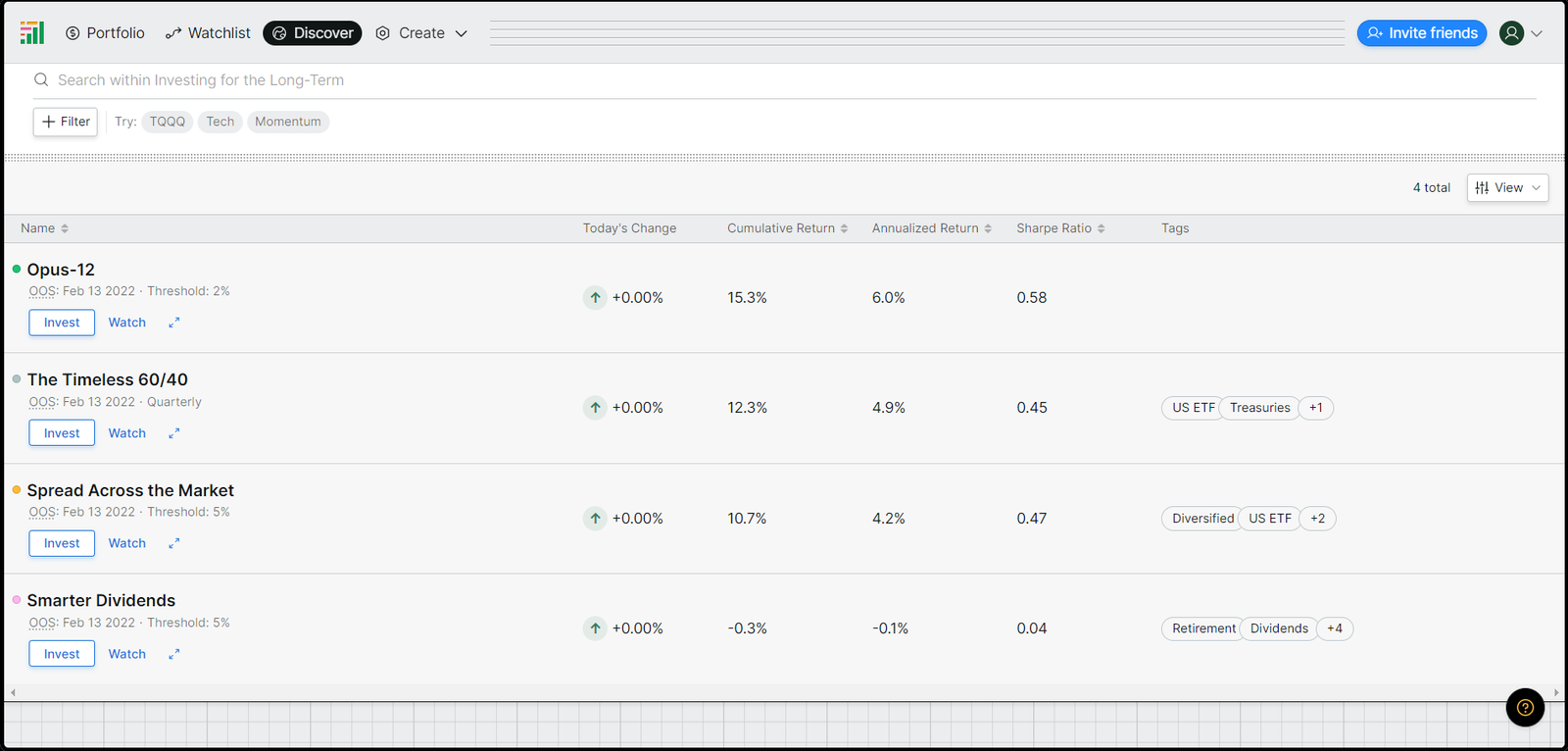

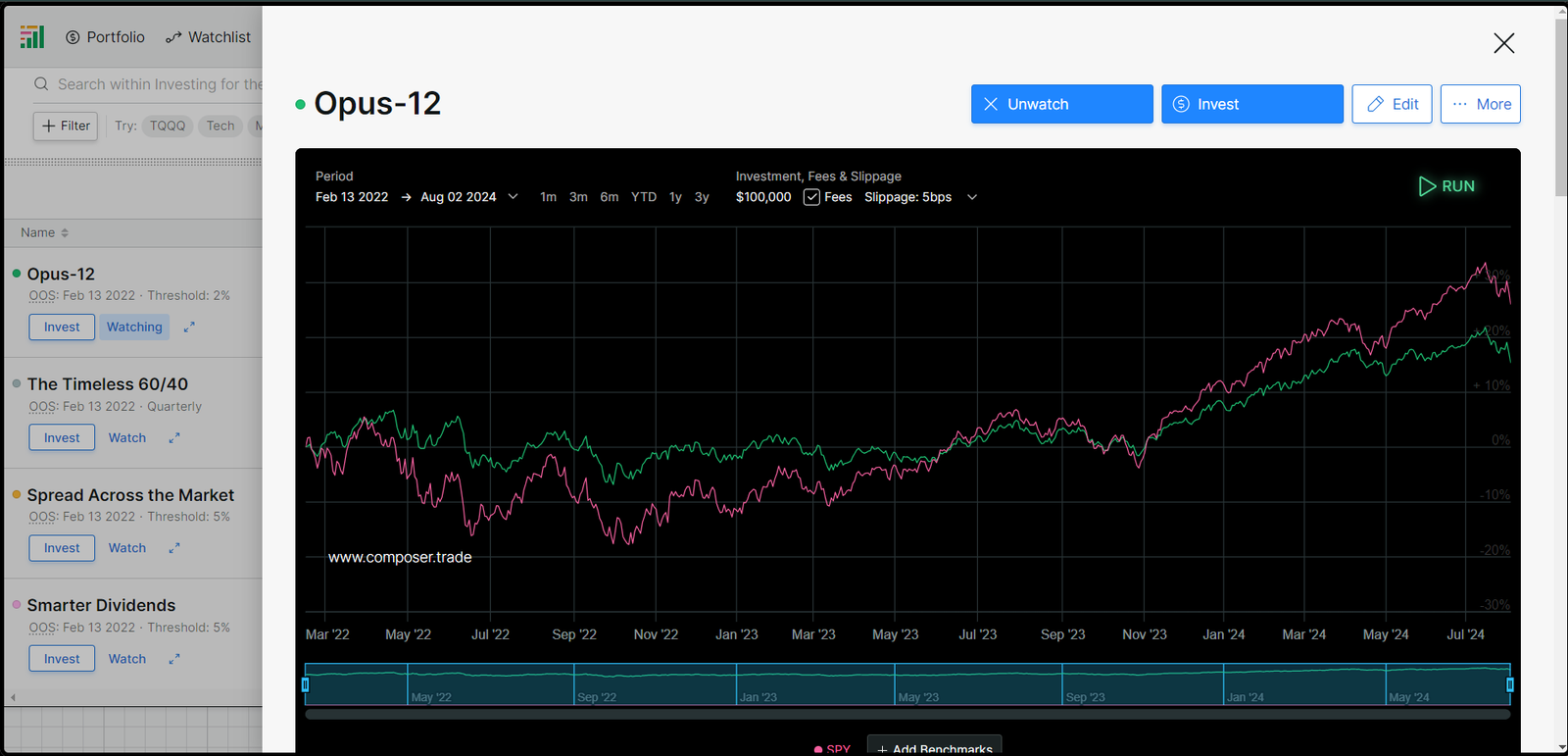

- Backtesting: Test strategies against historical data to evaluate their performance before going live.

- Automated Trading: Deploy strategies to trade automatically, ensuring timely and accurate execution.

- Real-Time Data: Access to real-time market data to make informed trading decisions.

- Custom Indicators: Utilize a variety of built-in indicators or create custom ones to enhance strategy development.

Benefits:

- Accessibility: Enables traders of all skill levels to develop and deploy complex trading strategies without coding.

- Risk Management: Allows users to test and refine strategies, minimizing risks before actual trading.

- Efficiency: Automates trading processes, saving time and reducing the likelihood of human error.

- Optimization: Provides tools to optimize strategies for better performance and higher returns.

- Scalability: Supports a wide range of trading assets and markets, allowing users to diversify their portfolios.

Target Audience:

- Individual Traders: Novice to experienced traders looking to automate their trading strategies and improve performance.

- Financial Advisors: Professionals seeking to enhance their services with advanced trading tools and automation.

- Institutional Investors: Firms aiming to leverage algorithmic trading for better investment outcomes.

- Hedge Funds: Funds looking to develop and deploy sophisticated trading strategies at scale.

- Academic Researchers: Researchers studying financial markets and trading strategies for academic purposes.

Use Cases:

Problem Statement:

Investors and traders face challenges in creating and managing complex investment strategies, often requiring significant time and expertise.

Application:

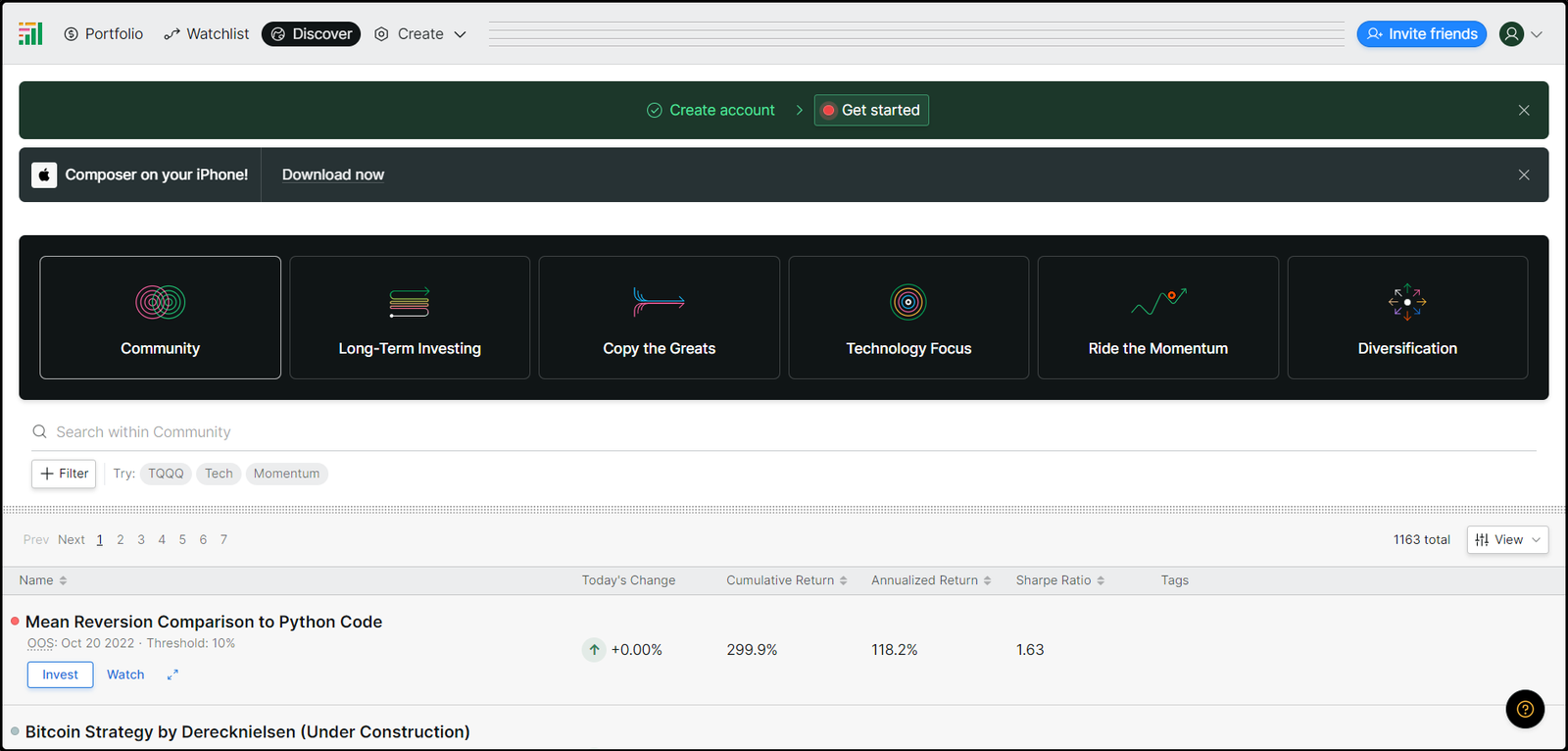

Composer uses AI to help users design, backtest, and deploy sophisticated investment strategies with ease. It provides a platform for users to create rule-based strategies, automating the trading process and offering real-time insights and performance metrics.

Outcome:

Enhanced investment strategy creation, improved portfolio performance, and time savings in strategy management.

Industry Examples:

- Finance: Financial advisors and individual investors use Composer to develop and test personalized investment strategies, improving portfolio returns and risk management.

- Hedge Funds: Hedge funds utilize Composer to automate trading strategies, reducing manual intervention and optimizing performance.

- Retail Investors: Retail investors employ Composer to gain access to advanced trading tools and insights, leveling the playing field with professional traders.

- Robo-Advisors: Robo-advisory services integrate Composer’s technology to enhance their automated investment offerings, providing clients with tailored and dynamic strategies.

- Wealth Management: Wealth management firms use Composer to streamline the creation and monitoring of client portfolios, improving service quality and client satisfaction.

Additional Scenarios:

- Cryptocurrency: Crypto traders can leverage Composer to create automated trading strategies for cryptocurrencies, taking advantage of market opportunities.

- Pension Funds: Pension funds can use Composer to optimize asset allocation and improve long-term returns for their beneficiaries.

- Insurance: Insurance companies can employ Composer to manage their investment portfolios, balancing risk and return more effectively.

- Endowments: University endowments and other institutional investors can use Composer to implement and monitor diversified investment strategies, ensuring financial stability.

- Family Offices: Family offices can utilize Composer to manage complex, multi-asset portfolios, aligning with the specific goals and risk profiles of their clients.

Reviews

There are no reviews yet.