Description

Key Features:

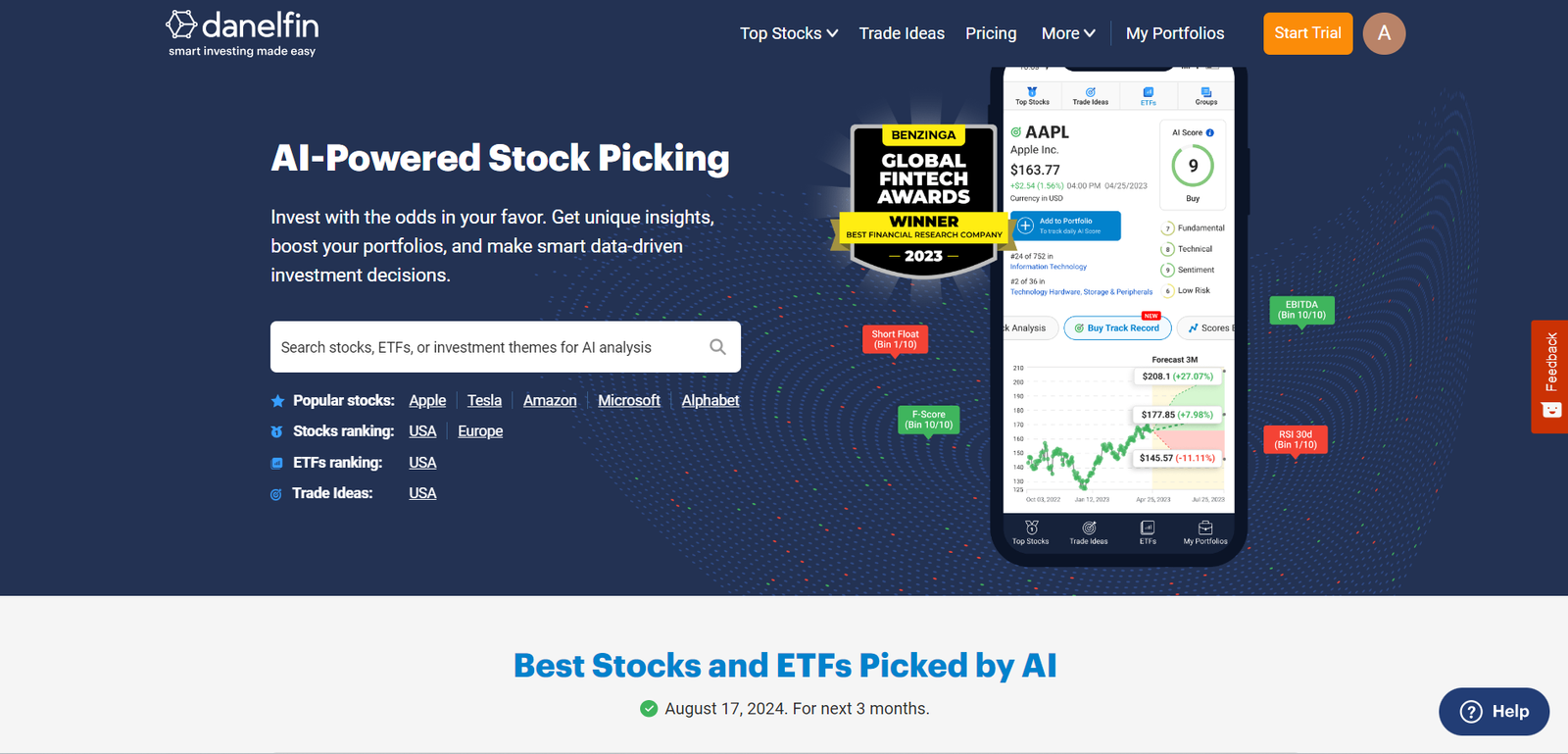

- AI-Powered Stock Analytics: Provides real-time AI-driven stock rankings based on an analysis of thousands of features per stock.

- AI Score: A unique ranking system that predicts the likelihood of stocks outperforming the market in the near future.

- Explainable AI: Offers transparent insights and detailed explanations behind each stock ranking, helping users understand the AI’s decision-making process.

- Portfolio Management Tools: Features tools for tracking AI Scores, managing stock portfolios, and receiving daily alerts on stock performance and recommendations.

- Data-Driven Decision Making: Delivers daily data analysis and market predictions to help investors optimize their portfolios and stay ahead of market trends.

Benefits:

- Smarter Investing: Leverages AI to provide accurate, data-backed stock recommendations, improving the likelihood of investment success.

- Enhanced Portfolio Management: Helps users manage their portfolios with daily AI-driven insights and real-time alerts.

- Explainable Insights: The Explainable AI feature ensures transparency in stock analysis, giving investors confidence in their decisions.

- Market Advantage: By analyzing thousands of data points per stock, Danelfin helps investors stay ahead of the curve and make informed decisions that can lead to better returns.

- Continuous Learning: The platform continuously adapts and updates based on new data, providing users with up-to-date information for optimized decision-making.

Target Audience:

- Individual Investors: Seeking AI-powered tools to enhance their investment strategies and stock-picking abilities.

- Financial Advisors: Looking to utilize cutting-edge AI analytics to provide better recommendations for their clients.

- Portfolio Managers: Needing real-time data and insights to optimize portfolio performance.

- Retail Traders: Wanting a competitive edge in stock market investments through AI-driven analysis.

Additional Information:

Danelfin stands out for its use of Explainable AI, offering not just predictions but clear, understandable insights into how those predictions are made. This transparency sets it apart from other stock analytics platforms, providing investors with the confidence to act on AI-driven recommendations. With a focus on optimizing stock performance and enhancing portfolio management, Danelfin is an essential tool for anyone serious about improving their investment outcomes.

Use Cases:

Problem Statement:

Investors often face challenges in making data-driven decisions due to the complexity of analyzing vast amounts of market data and stock performance indicators.

Application:

Danelfin is an AI-powered stock analytics platform that helps investors make smarter investment decisions. It uses artificial intelligence to analyze thousands of features and indicators for each stock, calculating the probability of beating the market. The platform ranks stocks by AI Score, identifies trade ideas, and provides insights to optimize portfolio performance. Investors can use Danelfin to find winning stocks, monitor their portfolios, and make data-driven decisions.

Outcome:

Investors using Danelfin can enhance their portfolio’s performance, increase returns, and reduce risks by leveraging AI-driven stock analysis and trade insights.

Industry Examples:

- Retail Investors: Retail investors use Danelfin to discover high-performing stocks, helping them achieve better returns than traditional investment strategies.

- Hedge Funds: Hedge funds leverage Danelfin’s AI tools to identify profitable trade opportunities and manage large portfolios efficiently.

- Financial Advisors: Financial advisors utilize the platform to provide data-backed stock recommendations and optimize client portfolios.

- Day Traders: Day traders rely on Danelfin’s trade ideas and real-time stock analysis to execute profitable short-term trades.

- Retirement Funds: Pension and retirement funds use Danelfin to diversify portfolios and ensure steady long-term growth.

Additional Scenarios:

- Portfolio Managers: Portfolio managers use Danelfin’s AI insights to rebalance portfolios and reduce exposure to underperforming stocks.

- University Endowments: Educational institutions apply Danelfin’s AI-driven analysis to manage endowment funds, maximizing returns while minimizing risks.

- Corporate Investors: Corporations utilize Danelfin’s predictive analytics to make informed decisions about company stock buybacks and investments.

- Individual Investors: Individuals use the platform to track their portfolio’s AI Score and make necessary adjustments to outperform the market.

- Tech Startups: Startups in the fintech space use Danelfin’s data analytics capabilities to enhance their own financial technology solutions.

Reviews

There are no reviews yet.