Description

Key Features:

- Credit Card Fraud Detection: Automatically detect and prevent fraudulent activities in payments, reducing the risk of chargebacks and financial loss.

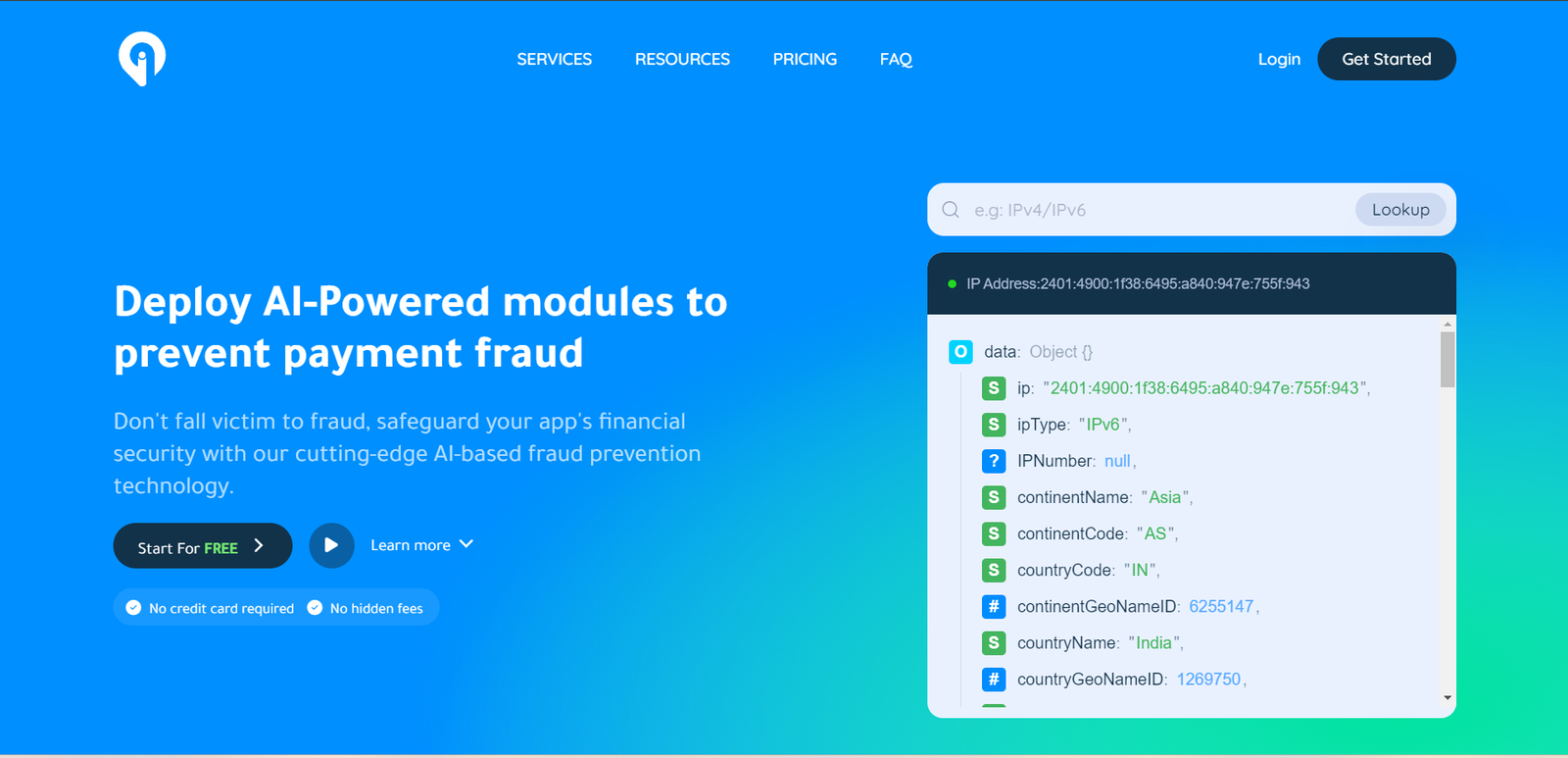

- IP Geolocation and VPN/Proxy Detection: Track and monitor the geographical location of users and detect VPN/proxy usage to prevent identity theft and unauthorized access.

- Profanity Detection: Automatically identify and filter negative language from user-generated content to maintain a positive environment.

- Data Validation: Validate user inputs, ensuring the accuracy and legitimacy of the information provided during sign-ups, transactions, and other interactions.

- BIN/IIN and IBAN Lookup: Fetch accurate details of debit/credit cards and validate IBANs for international transactions, ensuring compliance and preventing payment errors.

Benefits:

- Enhanced Security: Greip offers a robust set of tools that protect businesses from various types of fraud, from payment fraud to identity theft, ensuring the safety of online transactions.

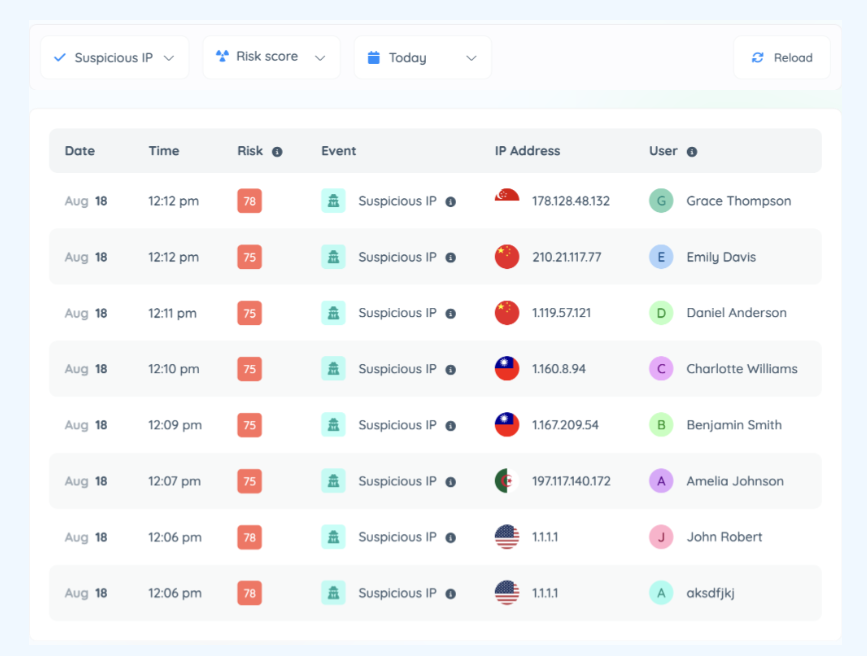

- Real-Time Monitoring: The platform provides real-time insights and proactive monitoring through its intuitive dashboard, helping businesses stay ahead of potential security threats.

- Scalable Solutions: Greip is designed to scale with businesses of all sizes, from small startups to large enterprises, offering flexible pricing plans and customizable integrations.

- Improved Customer Trust: By protecting customers from fraud and maintaining data privacy, businesses can enhance customer trust and loyalty.

Target Audience:

- E-commerce and Online Retailers: Ideal for businesses that handle online transactions and need to protect their financial operations from fraud.

- Financial Institutions: Suitable for banks, payment gateways, and financial service providers looking to enhance security in their payment systems.

- Developers and IT Teams: Perfect for development teams implementing fraud prevention and data validation tools in their applications.

Additional Information:

Greip’s AI-powered modules are designed to prevent a wide range of fraudulent activities, offering businesses a proactive approach to security. From payment fraud detection to IP geolocation and data validation, Greip provides a comprehensive suite of tools that integrate seamlessly with various platforms and applications. With its real-time monitoring capabilities, businesses can stay informed and secure, reducing the risk of fraud and ensuring the safety of their operations.

Use Cases:

Problem Statement:

As online transactions and digital services continue to grow, businesses face increasing challenges in protecting their systems from fraud, abuse, and malicious activities. Traditional methods of fraud prevention often fail to keep up with the evolving tactics of cybercriminals, leading to financial losses, data breaches, and reputational damage. Businesses need a more advanced and proactive approach to detect and prevent fraudulent activities in real-time.

Application:

Greip is an AI-powered fraud prevention platform designed to help businesses detect and prevent fraudulent activities across their digital platforms. The tool leverages advanced algorithms to identify suspicious behaviors, analyze patterns, and block malicious activities before they can cause harm. Greip is ideal for businesses in e-commerce, finance, and digital services that need to protect their systems and customers from fraud and abuse.

Greip’s key functionalities include:

- Real-Time Fraud Detection: The platform uses AI to monitor and analyze user activities in real-time, detecting and flagging suspicious behaviors that may indicate fraud or abuse.

- Pattern Analysis: Greip identifies patterns and trends in user behavior, allowing businesses to stay ahead of emerging threats and proactively prevent fraud.

- Customizable Rules and Alerts: The platform enables businesses to create custom rules and alerts based on their specific needs, ensuring that they can respond quickly to potential threats.

- Multi-Channel Protection: Greip provides protection across multiple digital channels, including websites, mobile apps, and APIs, ensuring that businesses are safeguarded from fraud regardless of where the threat originates.

- Comprehensive Reporting: The platform offers detailed reports and analytics on fraud attempts, helping businesses understand the nature of the threats they face and improve their security strategies.

Outcome:

By using Greip, businesses can significantly reduce the risk of fraud and abuse across their digital platforms. The platform’s AI-driven detection capabilities allow businesses to identify and block malicious activities in real-time, protecting their systems, customers, and revenues. Greip helps businesses stay ahead of evolving threats and maintain a secure online environment.

Organizations that adopt Greip benefit from:

- Enhanced Security: Real-time fraud detection and pattern analysis help businesses protect their platforms from malicious activities, reducing the risk of financial losses and data breaches.

- Increased Efficiency: By automating fraud detection and prevention, Greip reduces the workload on security teams and enables them to focus on more strategic tasks.

- Proactive Threat Prevention: Greip’s customizable rules and alerts allow businesses to stay ahead of emerging threats and prevent fraud before it occurs.

Industry Examples:

- E-commerce: E-commerce businesses use Greip to detect and prevent fraudulent transactions, account takeovers, and payment fraud. For example, an online retailer leverages the platform to monitor transactions in real-time and block suspicious activities, protecting their customers and reducing chargebacks.

- Finance: Financial institutions use Greip to protect their online banking platforms from fraud and abuse, ensuring that customer accounts and transactions remain secure. For instance, a bank uses the platform to detect unusual account activities, such as unauthorized withdrawals or transfers, helping them prevent fraud and safeguard customer funds.

- Digital Services: Digital service providers use Greip to prevent abuse and fraudulent activities on their platforms, such as fake account creation and spam. For example, a subscription-based service uses the platform to monitor sign-ups and block fraudulent accounts, ensuring that their platform remains secure and free from abuse.

- Gaming: Online gaming platforms use Greip to detect and prevent fraudulent activities such as cheating, account hacking, and payment fraud. For example, a gaming company uses the platform to monitor player behavior and block suspicious activities, ensuring a fair and secure gaming environment for all users.

- Healthcare: Healthcare providers use Greip to protect their digital systems from fraud and abuse, ensuring that patient data and transactions remain secure. For instance, a telemedicine platform uses the platform to detect suspicious login attempts and prevent unauthorized access to patient records.

Additional Scenarios:

- Insurance: Insurance companies use Greip to detect fraudulent claims and prevent abuse of their systems, ensuring that only legitimate claims are processed.

- Travel and Hospitality: Travel agencies and hospitality businesses use Greip to prevent fraud related to bookings, payments, and customer accounts, ensuring that their platforms remain secure and trustworthy.

- Education: Educational institutions use Greip to protect their digital platforms from fraud and abuse, ensuring that student data and transactions remain secure.

- Retail: Retail businesses use Greip to monitor customer transactions and prevent fraudulent activities such as payment fraud and account takeovers.

- Telecommunications: Telecom companies use Greip to detect and prevent fraud related to billing, account management, and service usage, ensuring that their platforms remain secure and reliable.

Reviews

There are no reviews yet.