Description

Key Features:

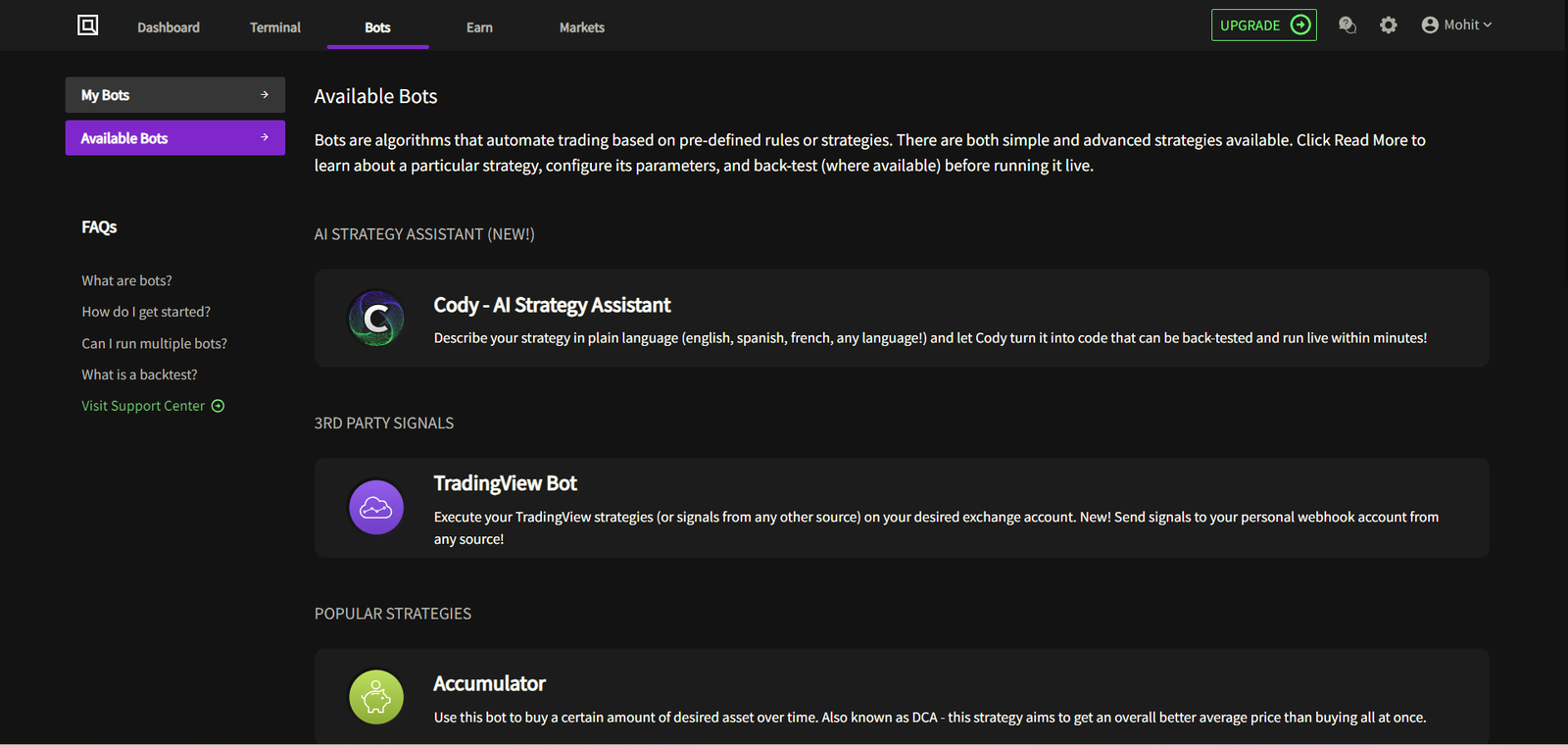

- AI-Driven Trading: Cody uses AI to automate complex trading strategies, translating user instructions written in plain language into executable algorithms.

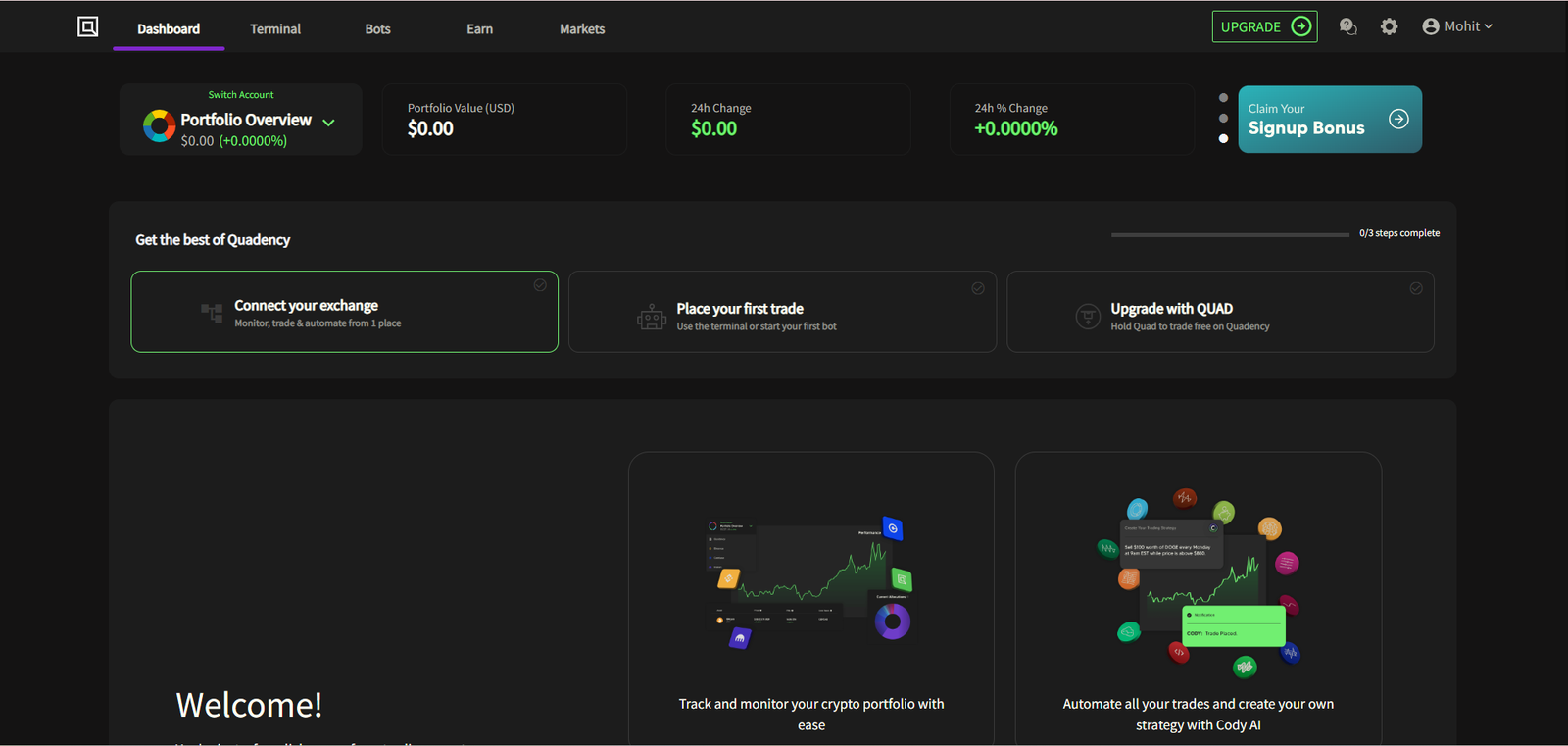

- Cross-Exchange Integration: Supports integration with various cryptocurrency exchanges, allowing users to manage their portfolios and execute strategies across multiple platforms.

- Custom Strategy Creation: Users can build and customize trading strategies without needing advanced coding skills, thanks to Cody’s intuitive interface.

- Automated Execution: The platform automates the execution of trading strategies, ensuring timely trades based on predefined conditions.

- Real-Time Data Analytics: Provides users with comprehensive data insights and analytics to inform trading decisions.

Benefits:

- Accessibility for All Traders: Quandency AI democratizes algorithmic trading, allowing users of all skill levels to participate in the crypto markets without requiring technical expertise.

- Efficiency and Automation: By automating strategy execution, Quandency AI saves time and reduces the need for manual intervention, allowing traders to focus on other aspects of their portfolios.

- Increased Accuracy: Cody’s AI-driven capabilities help reduce the risks of human error, ensuring strategies are executed precisely as intended.

- Seamless Portfolio Management: Users can manage their crypto assets across multiple exchanges within a single platform, making it easier to track performance and make informed trading decisions.

Target Audience:

- Cryptocurrency Traders: Ideal for both novice and experienced traders looking to automate their trading strategies and manage their crypto portfolios efficiently.

- Financial Analysts: Suitable for analysts who need real-time data insights and automation tools to optimize their trading performance.

- Developers and Technologists: Beneficial for tech-savvy individuals who want to experiment with AI-powered trading algorithms without writing complex code.

- Investment Managers: Perfect for professionals managing multiple crypto assets and portfolios, seeking an automated solution to streamline their workflow.

Additional Information:

Quandency AI is known for its seamless user experience, providing a simple yet powerful interface that allows users to access advanced trading tools and AI-powered assistance without the steep learning curve. By offering a flexible and scalable solution, Quandency AI is positioned as a valuable asset in the world of crypto trading. With features like cross-exchange integration, real-time data analysis, and automated strategy execution, it has become a preferred choice for crypto traders aiming to optimize their strategies and maximize returns.

Use Cases:

Problem Statement:

Cryptocurrency trading can be complex and time-consuming, requiring constant monitoring of markets, technical indicators, and portfolio rebalancing. Traders often struggle with executing strategies efficiently and lack the tools to automate these processes.

Application:

Quandency AI offers Cody, an AI-powered trading assistant that automates crypto trading strategies through natural language commands. Users can create, test, and execute trading strategies based on technical indicators, rebalance portfolios, and automate trading based on market data. Cody simplifies the trading process by allowing users to interact with the platform using intuitive, data-driven commands, making complex trading more accessible to everyone.

Outcome:

By using Quandency AI, traders can automate their crypto trading strategies, reducing the need for manual intervention and increasing trading efficiency. The platform’s AI-driven approach enhances decision-making by providing data-driven insights and enabling automation, leading to more consistent and optimized trading results. Traders can focus on strategy refinement while the platform handles execution and monitoring, resulting in better performance and reduced effort.

Industry Examples:

- Individual Traders: Retail crypto traders use Quandency AI to automate their trading strategies, increasing efficiency and minimizing manual effort.

- Crypto Hedge Funds: Hedge funds leverage Quandency AI to manage large portfolios, automate trades, and optimize performance across multiple exchanges.

- Day Traders: Day traders employ Quandency AI to execute quick, data-driven trades based on real-time technical indicators, improving their success rates.

- Exchanges: Cryptocurrency exchanges integrate Quandency AI to offer automated trading services to their users, enhancing their platform’s functionality.

- Wealth Management Firms: Wealth managers use Quandency AI to diversify their clients’ portfolios, automating rebalancing and reducing operational overhead.

Additional Scenarios:

- Token Launches: Quandency AI can be used to automate trading strategies during token launches, ensuring timely execution of trades.

- Market Monitoring: Traders use Quandency AI to set automated triggers based on market movements, executing trades at optimal times.

- Portfolio Diversification: Investors employ Quandency AI to automate portfolio rebalancing, maintaining desired asset allocations.

- Scalping Strategies: High-frequency traders utilize Quandency AI to execute rapid trades, optimizing their returns in volatile markets.

- Long-term Investments: Investors use Quandency AI to automate dollar-cost averaging strategies, consistently buying into assets over time.

Reviews

There are no reviews yet.